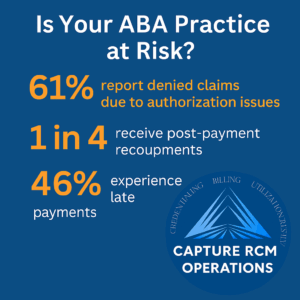

Even when you’re doing everything right for your clients, one misstep in billing or authorizations can throw your entire practice into chaos. And the worst part? You may not even see it coming—until claims are denied, authorizations expire, or a payor quietly flags your account.

If you’re a small ABA therapy provider feeling frustrated with your current RCM partner, especially around compliance issues, you’re not being overly cautious. You’re being wise.

At Capture RCM Operations, we help small ABA teams across the United States take back control—with compliance management that’s proactive, protective, and designed for real-world providers.

Compliance Isn’t a Box to Check—It’s Your Practice’s Lifeline

Many providers assume “compliance management” is a one-time thing—a quick policy review or a fancy onboarding checklist. But true compliance is not static. It shifts constantly with changing payor rules, evolving documentation requirements, and nuanced interpretations of what’s billable.

If your RCM partner treats compliance like an afterthought, they’re putting your entire operation at risk.

“We didn’t even know our authorizations had lapsed until families started calling about denied sessions.”

– Former client of a national billing service

This isn’t rare. It’s happening to more small ABA providers than ever—and it’s almost always avoidable with the right support.

What Good Compliance Management Actually Does

So what does real compliance management look like in practice? Here’s what we believe every RCM partner should provide—and what we’ve built into every client relationship:

- Proactive Monitoring: We track state and payor-level changes daily, so nothing slips through the cracks.

- Documentation Alignment: Our team reviews your treatment plans and session notes to ensure they meet evolving standards—before claims go out.

- Authorization Workflows: We build alert systems and calendars to make sure you’re never caught off guard by lapses.

- Clean Claim Audits: Every month, we audit a sample of claims to catch early issues and keep your payor relationships strong.

- Ongoing Staff Education: We train your internal team on what matters most for documentation and compliance, in plain English—not billing speak.

These aren’t bonus services. They’re the baseline for a partner who actually protects your practice.

The Real-World Cost of Poor Compliance

One expired authorization can lead to:

- Retroactive claim denials

- Loss of revenue for hours already worked

- Disrupted client care and family frustration

- Payor audits or flags that affect future authorizations

Now multiply that by a month—or a year—of small but compounding errors. That’s the true cost of a partner who “forgets to follow up.”

“We kept getting denied on codes we’d used for years. Turns out our policy changed three months ago. No one told us.”

– Capture Client, 2023

When compliance gaps go unnoticed, it’s not just about money. It’s about trust, morale, and the emotional toll of having to clean up someone else’s mess while still showing up for kids and families.

Small ABA Providers Face Unique Compliance Pressures

Let’s be honest—larger practices have full-time compliance officers. They have internal QA teams. They have legal departments.

You probably have… a clinical director, a part-time admin, and a mountain of competing priorities. That doesn’t make you less qualified—it makes you human. But it does mean you deserve a partner who can act as an extension of your team, not just a billing processor.

We see this all the time:

- Family-run ABA centers doing everything manually

- Providers unsure how long an initial authorization is valid

- Teams relying on one overworked staffer to “keep tabs” on everything

It’s not a failure. It’s a system problem. And we know how to fix it.

Success Story: “They Caught What We Didn’t Even Know to Look For”

One small ABA clinic in the Midwest came to us after three of their biggest payors stopped responding to claims. Their previous RCM vendor said, “It’s probably a payer glitch.”

It wasn’t.

We did a full compliance assessment and found multiple documentation mismatches—language that had become non-compliant after a policy revision. Within six weeks, we helped them:

- Resubmit over $80,000 in previously denied claims

- Rebuild clinical documentation templates to meet compliance

- Regain confidence with every single payor

Now, they’re not chasing payments. They’re planning growth.

“We’re not scared of audits anymore. That’s new for us.”

– Capture Client, 2024

How Capture Builds Compliance Into Every Step

We’re not a generic billing firm. We’re built specifically for behavioral health—and we know what small providers need most:

✔ Hands-on onboarding with a compliance review

✔ Custom workflows tailored to your practice size and payor mix

✔ Monthly check-ins to address new risks or issues

✔ Real-time alerts for expiring auths, payer changes, and code use

✔ Compassionate communication with your team, so you always feel supported

And unlike other vendors, we don’t wait for things to break. We prevent them.

Still Dealing with Denials? Let’s Talk.

If you’re feeling ignored, unheard, or flat-out dismissed by your current RCM team—it’s okay to want better. You deserve a partner who protects your time, your revenue, and your reputation.

We’re already doing this work for providers just like you. And we’d be honored to help you too.

Frequently Asked Questions About Compliance Management

What is compliance management in ABA billing?

Compliance management means proactively ensuring that your documentation, authorizations, and billing practices meet current payer standards. It’s how you avoid denials, reduce audit risk, and stay in good standing with insurance companies.

Isn’t compliance something we can handle in-house?

In theory, yes. In reality, most small ABA providers don’t have the time, tools, or updated payer access to do this consistently. That’s why partnering with a specialized RCM team like Capture makes such a difference.

How often do payer rules really change?

Constantly. Some payers update documentation standards or code usage quarterly, others do so annually or with zero warning. We monitor all major U.S. payers and stay ahead of those changes—so you don’t have to.

Will you help us get compliant before we start billing with you?

Absolutely. Every new Capture client receives a complimentary compliance audit and onboarding strategy to close any gaps before we touch a single claim.

What if we’ve already had issues with denials?

That’s often when providers find us. We specialize in helping teams recover from compliance breakdowns—and preventing them from happening again.

📞 Ready to take the next step?

Call (380) 383-6822 or visit to learn more about our compliance management services in United States.