In behavioral health, time is not just money—it’s recovery, reputation, and regulatory compliance. Billing Directors know this better than anyone. Yet many organizations still manage their revenue cycle in-house using legacy systems, generalist staff, and a process that was “good enough” five years ago.

It’s not good enough anymore.

If your A/R aging is creeping past 60 days—or worse, 90+—the question isn’t whether to rework your billing structure. It’s how. This guide breaks down the real costs, risks, and potential ROI of outsourcing your behavioral health revenue cycle management (RCM) vs. maintaining an internal billing team.

Explore our Behavioral health revenue cycle management services to see how Capture RCM supports faster, cleaner collections.

Why A/R Aging Is a Structural Problem—Not Just a Staffing One

Many billing leaders assume that A/R issues stem from underperforming billers or short-staffed teams. While those are real issues, they’re symptoms—not the root cause.

In-house billing teams in behavioral health often face:

- Under-resourced roles. Most internal teams are expected to juggle credentialing, claims, denials, patient billing, and appeals with limited training in behavioral health nuances.

- Generic systems. EHRs often prioritize clinical functionality over billing detail. That means critical revenue tasks like tracking payers’ behavior, flagging coding mismatches, or automating resubmissions are manual or overlooked.

- No time for root-cause analysis. In-house teams often don’t have bandwidth to dig into recurring denial trends, payer lag cycles, or fee schedule mismatches.

The result? Claims go unpaid. Denials pile up. Revenue stalls—and your team gets blamed for a system that’s working against them.

In-House Billing: Familiar, But Costly

Here’s what you’re really paying for when you manage billing in-house:

1. Salaries + Overhead

Even a lean team includes salaries, benefits, PTO coverage, and training. Add in management time, internal QA, and compliance reviews, and your staffing cost grows quickly.

2. Technology Stack

Licensing your practice management system or EHR may include basic billing tools—but specialized RCM functions (like eligibility checks, real-time denial tracking, and reporting dashboards) often cost extra.

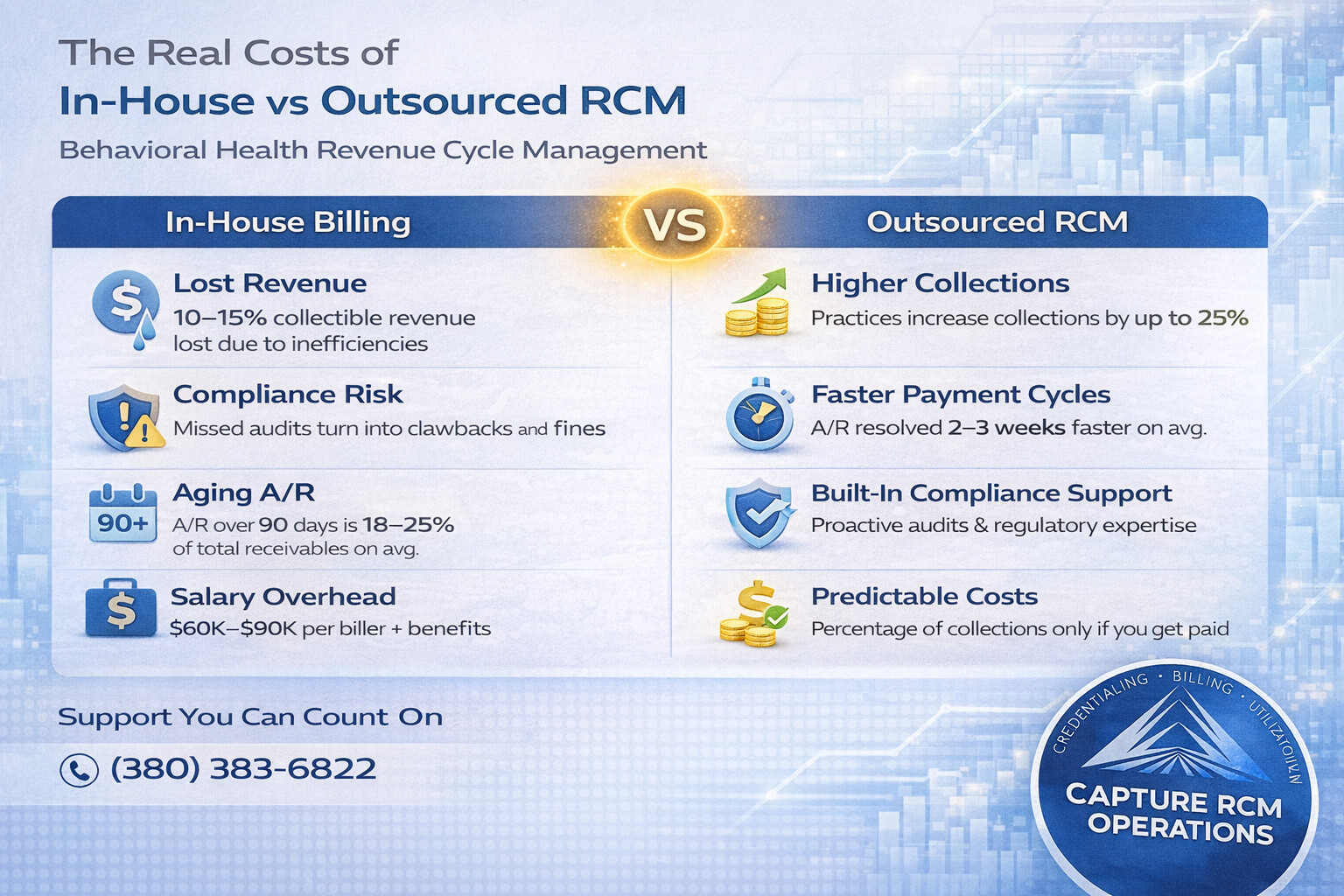

3. Lost Revenue

Delayed submissions, missed rejections, and aged claims all add up. Many in-house teams unknowingly lose 10–15% of collectible revenue due to process breakdowns.

4. Compliance Risk

Behavioral health billing includes high-scrutiny codes (like group therapy and ABA services). Mistakes aren’t just denials—they’re audit risks. Without dedicated RCM oversight, internal errors can go unchecked for months.

What You Gain With an Outsourced RCM Partner

Outsourcing RCM isn’t just about shifting work—it’s about leveling up your infrastructure.

Capture RCM clients consistently report:

- Reduced A/R aging by 30–45% in the first two quarters

- Fewer write-offs due to faster, cleaner claim cycles

- Full visibility into collections performance with weekly dashboards and monthly trend reporting

Here’s what makes that possible:

1. Behavioral Health Expertise

Outsourced RCM teams like Capture specialize in behavioral health billing. They’re fluent in CPT codes, authorization patterns, payer-specific behavior, and state-specific Medicaid intricacies. Your internal team can’t match that breadth.

2. Denial Management at Scale

Every claim is tracked until resolved. Denial patterns are flagged and addressed in real-time—not discovered weeks later in a monthly A/R report.

3. Credentialing Built-In

Strong RCM partners support—or fully handle—provider credentialing and CAQH management. That means fewer enrollment gaps, fewer denials, and faster cash flow when new hires start billing.

4. Data-Driven Process Improvements

With the right partner, RCM becomes a revenue intelligence function. You see where revenue is leaking, where payers are stalling, and where operational fixes can lift your bottom line.

The Real Cost Comparison: In-House vs. Outsourced RCM

| Category | In-House Model | Outsourced RCM |

|---|---|---|

| Staffing | $60K–$90K per FTE + benefits, PTO, training | % of collections (aligned incentives) |

| Software & Tools | Separate licenses for clearinghouses, reporting tools | Included in service fee |

| Compliance Oversight | Internal reviews, often manual | Audit-ready workflows and payer compliance support |

| Denial Recovery | Reactive, based on available time | Proactive tracking, real-time resubmission |

| Reporting & Insights | Monthly, manual, often incomplete | Weekly dashboards + monthly KPI meetings |

| Credentialing Support | Usually separate department | Integrated with billing to close enrollment gaps |

| Scalability | Slow and resource-intensive | Flexible teams built to expand or contract as needed |

Red Flags: When It’s Time to Rethink Your Billing Structure

If you’re seeing any of these patterns, your current RCM model is likely costing you more than you think:

- A/R over 90 days is more than 20% of your total receivables

- Credentialing delays are preventing new hires from billing

- Denial rates are consistently above 10%

- Rework rates are rising, and staff are spending hours re-filing claims

- Collections haven’t improved despite more hiring or software investments

Key Considerations Before You Outsource

Not all RCM vendors are created equal. Ask these questions before making the switch:

- Do they specialize in behavioral health? (If not, expect a painful learning curve.)

- Can they provide weekly performance data? (Transparency is non-negotiable.)

- Do they own credentialing support—or pass it off?

- Will they work within your EHR or require a new platform?

- How do they handle payer-specific nuances in your state?

Capture RCM answers “yes” to all of the above—and has the case studies to prove it.

Frequently Asked Questions

Is outsourcing RCM more expensive than in-house billing?

Not when you factor in lost revenue, rework time, software, and compliance risk. While outsourced RCM fees are usually a percentage of collections, they’re tied to performance—and often less than the all-in cost of staffing and tools.

Will I lose control if I outsource my billing?

No. A good RCM partner increases your visibility and gives you better control. Capture RCM provides weekly dashboards, real-time claim status, and regular check-ins so you’re always informed.

How fast will I see improvements in collections?

Most Capture clients start seeing measurable improvements in A/R aging and clean claim rates within 60–90 days.

Can an outsourced partner handle credentialing too?

Yes. At Capture RCM, credentialing is fully integrated with our billing services. That means no more handoffs or communication gaps—and faster revenue from new hires.

What EHRs do outsourced RCM providers work with?

Capture RCM integrates with all major behavioral health EHRs. We work within your system to maintain continuity and reduce disruption.

You Don’t Need to Tolerate Broken Billing

When A/R aging becomes the norm, many Billing Directors feel stuck—like the only solution is to hire more staff or accept longer delays. But in most cases, the real fix isn’t more people. It’s a better system.

📞 Call (380) 383-6822 or visit to learn more about our Behavioral health revenue cycle management services. Let’s cut your A/R aging, improve your cash flow, and give your billing team the support they need to succeed.